As the name suggests, variable costing is a method that focuses on the product’s variable costs being manufactured. Despite these disadvantages, period costs are a valuable tool for management accounting and can provide businesses with a more accurate picture of their financial position. Management can make more informed decisions about allocating resources and improving performance by understanding the different types of period costs and how they impact the business. As a result, absorption costing can lead to managers making decisions that are not in the company’s best interests. For example, a manager might decide to increase production even if there is no demand for the product simply because it will increase profit margins.

Key Differences and Income Effects Under Both Methods

The other main difference is that only the absorption method is in accordance with GAAP. This is because depreciation is a way of allocating the cost of a long-term asset over its useful life. Recording depreciation in the period in which it is incurred ensures that the financial statements reflect the true economic position of the business. There are two main methods of accounting for costs in a business – Absorption Costing and Variable Costing.

The purpose of period and product costs

In contrast, Absorption costing is where all the absorbed costs are taken into account. Under this method, all the fixed and variable production costs are deducted, and then fixed and variable selling expenses are deducted. Using the absorption costing method will increase COGS and thus decrease gross profit per unit produced so companies will have a higher breakeven price on production per unit. The variable direct costs and fixed direct costs are subtracted from revenue to arrive at the gross profit in either case. The management can make better decisions if the per-unit cost stays constant, which happens with variable costs.

Variable Costing Versus Absorption Costing Methods

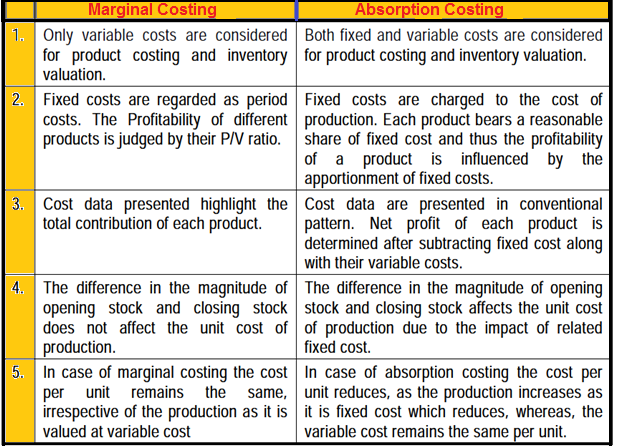

The key difference from variable costing is that fixed manufacturing overhead costs are treated as product costs under absorption costing. With absorption costing, gross profit how to write an invoice – common types of invoices is derived by subtracting cost of goods sold from sales. Cost of goods sold includes direct materials, direct labor, and variable and allocated fixed manufacturing overhead.

What Are the Advantages of Variable Costing?

In contrast to the variable costing method, every expense is allocated to manufactured products, whether or not they are sold by the end of the period. Based on absorption costing methods, the additional unit appears to produce a loss of $0.50, and it appears that the correct decision is to not make the sale. Variable costing suggests a profit of $0.50, and the information appears to support a decision to make the sale. Management may well decide to sell the additional unit at $9.50 and produce an additional $0.50 for the bottom line. Remember, no other costs will be generated by accepting this proposed transaction. If management was limited to absorption costing information, this opportunity would likely have been foregone.

Accounting for All Production Costs

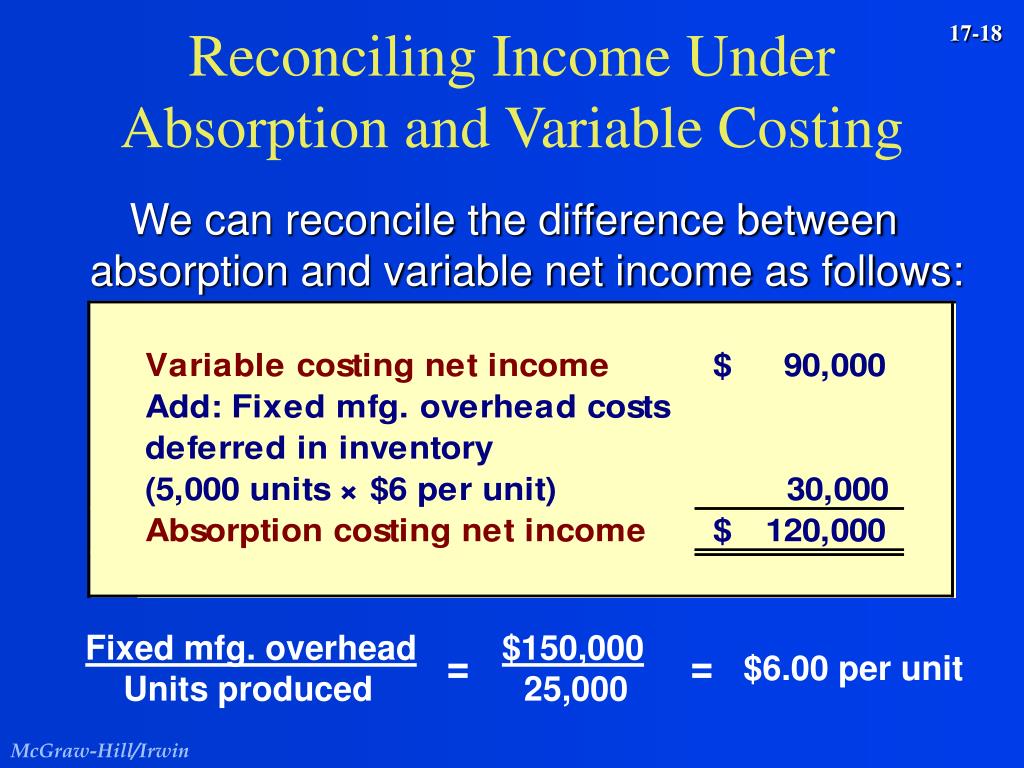

If the 8,000 units are sold for $33 each, the difference between absorption costing and variable costing is a timing difference. Under absorption costing, the 2,000 units in ending inventory include the $1.20 per unit share, or $2,400 of fixed cost. That cost will be expensed when the inventory is sold and accounts for the difference in net income under absorption and variable costing, as shown in Figure 6.14. That cost will be expensed when the inventory is sold and accounts for the difference in net income under absorption and variable costing, as shown in Figure 8.1.4.

- Absorption costing and variable costing are two different methods of accounting for product costs.

- By understanding how these costs affect the company’s bottom line, management can make better strategic decisions about allocating resources and improving profitability.

- Under absorption costing, direct materials, direct labor, and overhead are all included in the cost of a product.

Companies must choose between absorption costing or variable costing in their accounting systems, and there are advantages and disadvantages to either choice. Absorption costing, or full absorption costing, captures all of the manufacturing or production costs, such as direct materials, direct labor, rent, and insurance. On the other hand, variable costing only includes variable manufacturing costs in the cost of each unit produced. As a result, reported profits under variable costing are not influenced by changes in inventory levels. This can provide a clearer picture of the profitability of a company’s operations, especially when inventory levels fluctuate significantly.

Ultimately, companies should analyze their specific business and information needs and decide whether variable costing or absorption costing better aligns with their operational goals and objectives. Key factors to consider include GAAP compliance needs, how cost data is used for decision-making, and desired inventory valuation methods. Overall, absorption costing principles better align with financial accounting standards and provide a more accurate, stable view of manufacturing costs. Companies have to weigh these factors based on their specific accounting needs and industry dynamics when choosing between the two methods.

Contribution margin under variable costing is defined as sales revenue less variable product costs. This is an important metric as it represents the residual amount that is available to cover fixed costs and provide profit after the variable costs of production have been covered. The key difference between absorption costing and variable costing lies in how fixed manufacturing overhead costs are handled. Absorption costing fails to provide as good an analysis of cost and volume as variable costing. If fixed costs are a substantial part of total production costs, it is difficult to determine variations in costs that occur at different production levels. This makes it more difficult for management to make the best decisions for operational efficiency.